CUSTOMS ADVICE

AND SUPPORT

AVOID DELAYS BY FILLING INCUSTOMS FORMS CORRECTLY

Please Note - The services you have selected can only be found on our dedicated {{redirect.DestinationDescription}} website.

Click continue to visit {{redirect.DestinationDescription}}.

Customs Guide

If you are sending a parcel to a country outside the UK, you’ll need to provide the relevant customs forms, including a customs invoice with your parcel. Since the UK left the EU’s single market and customs union on 1st January 2021, this includes parcels sent to EU countries.

Our international booking form includes a ‘Customs information’ section. This only takes a few minutes to complete and we’ll use the information you provide to generate a Pro-forma or commercial invoice which will print with your shipping label.

In this our customs guide, we outline each of the additional fields in our international booking form and the information you need to provide for each to ensure your customs labels are correct. You can also watch our step-by-step video, which will walk you through the process from start to finish. Ensuring you have the right customs declaration form for sending from the UK is easy with us.

HOW TO BOOK AN INTERNATIONAL DELIVERY

WHEN DO YOU NEED TO PROVIDE A CUSTOMS INVOICE?

If you are sending a parcel outside of the UK, you will need to provide a customs invoice with it. This itemised invoice tells customs officials in the destination country about the sender, recipient and what’s inside the parcel, and is used to calculate the amount of duties and taxes which need to be paid.

UK customs has changed since Brexit. Before the UK left the EU’s customs union and single market, you only needed to provide a customs invoice when sending a parcel outside of the EU but since 1st January 2021, the relevant customs forms are also needed for all EU countries as well.

What’s the difference between a commercial and pro-forma invoice?

A commercial invoice is needed when you are sending goods outside the UK which have a commercial value. Alternatively, if you are sending a gift or a personal item, you will need to provide a Pro-forma invoice. Don’t worry too much about the distinction between the two – we’ll automatically generate the correct type of invoice and customs label based on the information you provide when completing the booking form.

Duties and taxes

When the parcel arrives in the destination country, duties and taxes may be due. Customs officials will use the value, origin, description and tariff code to calculate the amount due so it’s important you fill in this information accurately.

Your recipient will receive a bill for the duties and taxes due on the shipment. However, as the sender you are ultimately liable and will be billed for duties and taxes should the recipient refuse the package or refuse to pay. If these duties and taxes aren’t paid, the shipment can be held for customs clearance.

For more information, please visit the HM Revenue & Customs website and look up the country you are sending the parcel to.

There is a trade deal in place between the EU and UK customs which agrees to ‘zero custom duties’ – this means that you won’t need to pay duty on parcels sent to an EU country as long as the contents meet all the necessary ‘rules of origin’ requirements. However, VAT will still be charged according to the rate that applies to the destination country.

You must state the true and accurate value of all goods inside your parcel(s) in an itemised invoice to clear customs. Failure to do so means your parcel(s) may incur delays, fines, or penalties.

How to generate a customs document

As part of the booking process, you will need to provide the following information for your customs forms. This will then be used to generate a pro-forma or commercial invoice (depending on the type of items you are sending).

1. Sender details

You will need to provide your full name, address and telephone number so we can get in touch with you should there be an issue with your shipment.

2. Recipient details

In addition, please give the recipient’s name, address, email address and telephone number.

3. VAT status

There are three options to choose from: ‘Personal individual’, ‘Company-Non-VAT registered’ and ‘Company-VAT registered’. If you select ‘Company – VAT registered’, you will be asked for your VAT number so make sure you have this to hand.

4. EORI number

This field will only appear if you are sending to a European destination and have selected ‘Company-VAT registered’ as your VAT status. If you are a business sender and don’t already have an EORI number, you can register for one on the HMRC website.

Please note: a special type of EORI number, known as an XI EORI number, is needed to send parcels to Northern Ireland. To obtain an XI EORI number, simply register with the Trader Support Service.

5. Recipient’s EORI / PID number – optional field

If you’re sending to a business, recipient information, such as their Economic Operators Registration and Identification number (EORI) or Personal identification Number (PID), are recommended to support the import customs clearance process within the destination country. By providing this you will help avoid delays in clearance or possible additional fees where clearance cannot be started.

6. Reason for export

Select the reason why you are sending the item from the drop down list. Possible reasons include: documents; gift; sample; sold.

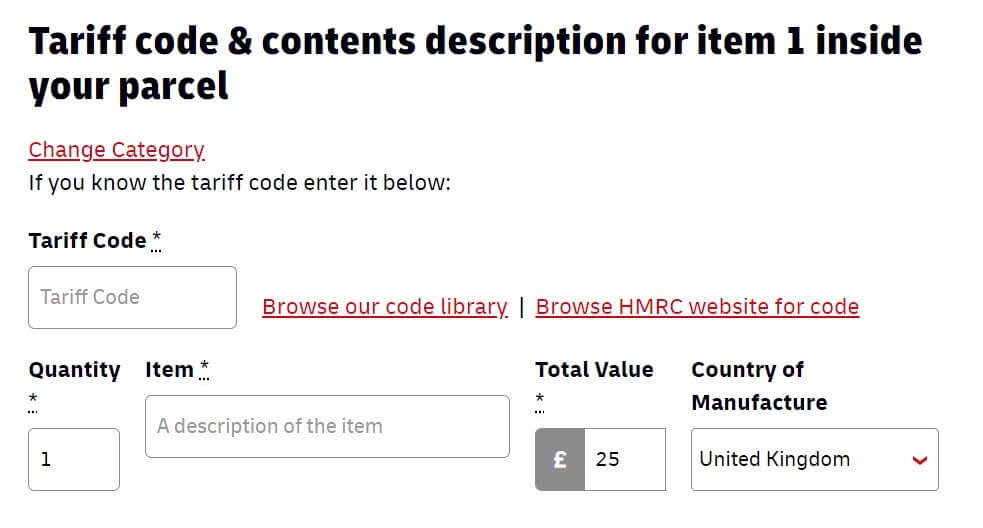

7. Tariff code (or commodity code)

A commodity code is an 8-digit number used to classify traded products. The code tells customs officials in the destination country what’s inside your parcel and is used to calculate the duties to be paid.

In our booking form, we make it easier for you to find the tariff code you need by listing some of the most popular items which are sent through our network. All you need to do is select the item you are sending from this list and the tariff code field will auto-fill with the correct code. If your item does not appear in the list, select ‘Other’ and you will be taken to the HMRC website to search for your item.

Alternatively, if you know the tariff code for the item you are sending, simply click ‘Enter manually’ and type the 8-digit code into the box.

8. Description

Make sure you give a detailed description as items with a vague description risk being held up in customs. Always include what the item is, what it is made from and what it will be used for. For example, instead of ‘Clothing’ the description should be ‘Men’s knitted jumper, 70% cotton and 30% polyester’.

9. Country of manufacture

This is the country where the item was originally manufactured, produced or grown. It’s important you fill this in accurately and to the best of your knowledge.

If you are sending a parcel to an EU country, this information is needed to benefit from the EU to UK Trade Agreement of ‘zero tariff’ (zero customs duties).

10. Value

Provide an accurate value for the item you are sending. If there is more than one item, give an itemised list with a value for each item in the parcel.

AFFIX THE CUSTOMS INVOICE SECURELY TO YOUR PARCEL

Once you have completed your customs forms and paid for shipping, your customs label and five copies of the invoice will print out. You should attach all five copies to your parcel – we recommend using a clear plastic document wallet to waterproof and protect your documents. It’s also a good idea to put a copy of the invoice inside your parcel which the customs official can use should the outer copies get damaged or go missing.

Prohibited items

We have a general list of prohibited items for all international countries. Remember, this list isn’t exhaustive and each country has its own individual guidelines. If you are at all unsure about whether or not you can send an item, please refer to the destination country’s government page. If you send an item that is restricted either by us or the country you are sending to, you risk your parcel being returned and the cost being charged back to you.

Ready to ship abroad? Get a quick quote and book today.